What Is the Pre-Custody Process for Secured Debt?

Overview of the pre-custody process for secured debt instruments including required investor sponsor documentation, the private custody process timeline, how to title your investment and where to submit your documents.

Pre-Custody Process

Prior to accepting custody of an investment, STRATA Trust Company (“STRATA”) completes a pre-custody check to make sure we can meet our custodial responsibilities and the administrative requirements of the investment. Use this checklist to ensure you’ve gathered all the necessary documentation to proceed with your unsecured corporate debt investment. The information required on this checklist and document submission is prior to the purchase, transfer, or rollover of an unsecured corporate debt investment.

STRATA Trust does not evaluate or perform any due diligence or suitability reviews on any investment or investment sponsor.

Prohibited Transactions

Prohibited Transactions

Please contact us if the type of unsecured corporate debt investment you wish to process is not on this checklist. There are certain types of investments that we will not process including, but not limited to:

- Investments that would be deemed as Prohibited Transactions (i.e., self-dealing) under IRC 4975

- Unsecured Promissory Notes to individuals

- Unsecured Corporate Debt that is not part of a Regulation D offering

- Notes secured by life insurance, life settlements, or collectibles since certain assets are prohibited in IRAs under IRC Section 408.

- Other investment types not custodied by STRATA include, but are not limited to, single-member or family-owned entities, foreign investments (entities, real estate), general partnerships, joint ventures, working interests, life settlements/viaticals, S-corporation stock, direct ownership of digital currencies, direct investments in the cannabis industry, livestock, vehicle titles, or equipment.

Debt Instrument Registration

Debt Instrument Registration

The investment registration must reflect the following named investment owner.

- STRATA’s Tax ID should be used in place of the investor’s SSN to retain the tax-exempt status for the IRA investment.

STRATA Trust Company Custodian FBO (Accountholder Name) IRA (Account #) PO Box 23149 Waco, TX 76702 Tax ID: 26-2637994

Important Reminder

Please make sure that all items must be received in good order at least 48 hours before any scheduled closing. Pre-Custody Documents

Pre-Custody Documents

To onboard your new investment to STRATA, please provide the following documents at the same time.

Investment Issuer to Provide:

.png?width=134&name=Untitled%20design%20(42).png)

-

-

-

-

-

- Copy of the Note: Since the loan is an individually negotiated transaction, the debt instrument provided to STRATA should reflect the named payee/lender as: STRATA Trust Company Custodian FBO (Accountholder Name) IRA (Account #). An unsigned draft is acceptable prior to funding.

- Security Document: The deed of trust/mortgage/security agreement/contract must reflect the named lender as STRATA Trust Company Custodian FBO (Accountholder Name) IRA (Account #). An unsigned draft is acceptable prior to funding.

- Assignment: If periodic payments consist of principal and interest, please provide an electronic copy (.xls or .xlsx) of the amortization schedule. Otherwise, STRATA will convert the amortization schedule to an electronic copy which may result in small rounding differences.

-

-

-

-

Document Submission:

Investment issuers may submit pre-custody documentation directly to STRATA through our Investment Hub.

Secured Debt Custody Process Overview

Secured Debt Custody Process Overview

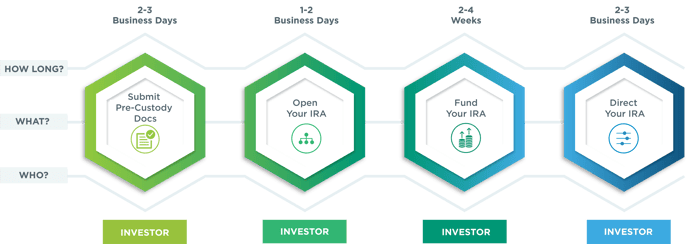

This timeline is approximate, based on if the required documents are received in good order. If transferring from another custodian or rolling over an IRA asset from another institution, STRATA is dependent on the existing service providers' transaction process times.

Once all the information has been completed and we have received all the necessary documentation, it will take up to 2-3 business days for us to determine whether STRATA is able to custody the debt. The documents listed above provide a guideline for a typical private debt custody check. Please note that STRATA has the right to request additional documentation to complete the pre-custody process.

Private Debt Investment Checklist

STRATA's Private Debt Investment Checklist includes form links and a step-by-step guide. Download and save, email, or print!

Next Steps:

Once your pre-custody paperwork is submitted and your asset is approved, then you are ready to open your STRATA IRA and direct your investment.

- Click here when you are ready to Open and Fund Your STRATA IRA account. You will be able to assign IRA beneficiaries, select which IRA you will be investing with, and easily electronically sign and submit forms.

- Click here to learn about investor-required transaction documents needed to direct funds to your new investment.

Additional Resources:

Additional Resources:

- STRATA IRA Fee Schedule - Overview account, processing, and service fees for your STRATA IRA.