How Do I Direct a Corporate Debt/Convertible Note Transaction After My Investment Has Been Onboarded?

Overview of the transaction documents, submission process, custody timeline, and asset registration requirements for corporate debt/convertible note investments after an investment has been accepted for custody with STRATA.

Transaction Documents to Provide to STRATA

.png?width=200&name=Untitled%20design%20(41).png)

-

-

-

-

-

-

-

- STRATA's Investment Direction - Private Investments form - This form authorizes STRATA to send funds from the STRATA IRA to the investment issuer once the investment is onboarded. Processing delays can be avoided by ensuring all sections of the form are completed.

- The Subscription Document, Note Purchase Agreement, or Lender’s Agreement - The accountholder should complete and sign the corporate debt/convertible note issuer’s subscription document, note purchase agreement, or lender’s agreement. After this has been signed by the accountholder, STRATA will sign in its capacity as the IRA custodian.

-

-

-

-

-

-

Document Submission

Document Submission

You may submit transaction documentation using email, fax, or mail, please use only one method below:

| Email: | Operations@StrataTrust.com |

| Fax: | 512.495.9554 |

| US Mail: | PO Box 23149, Waco, Tx 76702 |

| Overnight: | 7901 Woodway Drive, Waco TX 76712 |

Corporate Debt/Convertible Note Custody Process Overview

Corporate Debt/Convertible Note Custody Process Overview

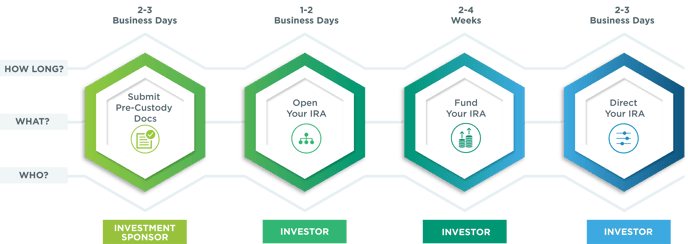

This timeline is approximate, based on if the required documents are received in good order. If transferring from another custodian or rolling over an IRA asset from another institution, STRATA is dependent on the existing service providers' transaction process times.

What to Expect After STRATA Processes the Transaction

What to Expect After STRATA Processes the Transaction

Once all the documentation has been completed and submitted, your STRATA IRA has been opened and funded, then it will take up to 2-3 business days for us to direct your investment.

- STRATA should hold the fully-executed debt instrument for safekeeping. Please send it to STRATA as soon as possible after the transaction proceeds are received.

- The debt instrument must reflect the following named payee as follows:

STRATA’s Tax ID should be used in place of the investor’s SSN to retain the tax-exempt status for the IRA investment.STRATA Trust Company, Custodian FBO (Accountholder Name) IRA (Account #) PO Box 23149, Waco TX 76702 Tax ID:26-2637994 - STRATA does not provide any loan servicing or collection duties. The account holder assumes all responsibilities to monitor the terms of the loan and ensure the borrower makes all payments in a timely manner.

- Loan payments must be deposited directly to the STRATA IRA. If there is a third-party servicing agent, the agent may forward the payments to be deposited to the IRA. Payments should not be sent directly to an IRA owner’s personal or business account.

Additional Resources:

Additional Resources:

- STRATA IRA Fee Schedule - Overview account, processing, and service fees for your STRATA IRA.

- What Is the Pre-Custody Process for Corporate Debt/Convertible Note Investments?

- Private Debt Investment Checklist - Document checklist with quick links and step-by-step guide.