What Is Unrelated Business Taxable Income (UBTI)?

Unrelated Business Taxable Income (UBTI) occurs when a retirement account earns active business income, which is considered unrelated to the tax-exempt status of the IRA (including Roth IRAs) under federal tax law, and the income is subject to its own tax.

Taxable Event Triggers

A taxable event happens if the IRA-owned investment earns income from selling goods or performing services with the intent to profit from an ongoing trade or business. Limited partnerships, limited liability companies, real estate, and other entities that carry on an unrelated business or borrow funds to finance the acquisition of property may generate taxable income. Exclusions apply, but generally, examples include:

- Interest

- Dividends

- Royalties

- Capital Gains

- Rents (if not debt-financed)

Investments that are structured as hedge funds, notes, REITs, and other private corporations that are not LLCs or LPs will not trigger UBTI.

Accountholder Responsibilities

The account owner is responsible for UBTI. Typically, investors that have investments generating UBTI will have receive a Schedule K-1 which is prepared by your investment sponsor and sent directly to the investor and the IRS. A copy of the K-1 is generally not sent to your IRA custodian.

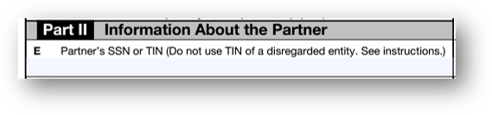

To avoid IRS confusion between your IRA income and personal income, it is important to verify the K-1 document reflects the correct tax identification number. If not, work with your investment sponsor to correct the form. Part II, box E of the K-1 requires a tax identification number (TIN) of the partner, and for IRA owners the document should reflect STRATA’s TIN of 26-2637994 or the standalone IRA EIN rather than your social security number.

Investors that owe UBTI will work with their tax professional to determine if IRS Form 990-T will need to be filed. As a custodian for self-directed IRAs, STRATA does not review K-1, file IRS Form 990-T, nor do we advise on or calculate UBTI.

STRATA does not provide investment, legal, or tax advice. Individuals should consult with their investment, legal, or tax professionals for such services. Find out more with STRATA's Quick Guide to UBTI & UDFI: