What is the Pre-Custody Process for an In-Kind Transfer or Rollover of Directly Owned Real Estate?

Overview of the pre-custody process for in-kind or rollover of directly owned real estate assets including required documentation, the custody process timeline, how to title your investment and where to submit your documents.

Pre-Custody Process

Prior to accepting custody of an investment, STRATA Trust Company (“STRATA”) completes a pre-custody check to make sure we can meet our custodial responsibilities and the administrative requirements of the investment. Use this checklist to ensure you’ve gathered all the necessary documentation to proceed with your in-kind transfer or rollover of directly owned real estate investment.

STRATA Trust does not evaluate or perform any due diligence or suitability reviews on any investment or investment sponsor.

Prohibited Transactions

Prohibited Transactions

There are certain types of investments that we will not process including, but not limited to:

- Investments that would be deemed as Prohibited Transactions (i.e., self-dealing) under IRC 4975

- Single-member or family-owned entities (owned 50% or more by family members)

- Personal use of the property by you or any disqualified persons

Additional prohibited transactions of real estate investments include, but are not limited to:

- Paying for expenses personally rather than directing the payment from your STRATA IRA

- Using the property in your STRATA IRA as collateral for a personal loan

- Selling the property from your STRATA IRA to yourself or a disqualified person

Asset Registration

Asset Registration

The investment registration must reflect the following named investment owner.

- STRATA’s Tax ID should be used in place of the investor’s SSN to retain the tax-exempt status for the IRA investment.

STRATA Trust Company Custodian FBO (Accountholder Name) IRA (Account #) PO Box 23149 Waco, TX 76702 Tax ID: 26-2637994

Important Reminder

- Please make sure that all items must be received in good order at least 48 hours before any scheduled closing.

- If your IRA will not own 100% of the property, the property title and closing documents should reflect STRATA Trust Company Custodian FBO (Accountholder Name) IRA (Account #) as to an undivided interest of ____%.

Pre-Custody Documents to Provide to STRATA

Pre-Custody Documents to Provide to STRATA

.png?width=200&name=Untitled%20design%20(42).png)

-

-

-

-

-

- Investment Direction Real Estate: Complete and sign STRATA’s Investment Direction - Real Estate form to indicate an in-kind transfer or in-kind rollover of the property. To avoid any processing delays, please be sure to complete all sections of the form.

-

-

-

-

-

-

-

-

-

-

-

- Copy of the Existing Deed: Provide a copy of the existing deed which shows your current IRA custodian or plan as the owner for the benefit of your IRA or qualified plan.

- Copy of the Existing Title Policy: Provide a copy of the existing title policy which shows your current IRA custodian or plan as the insured for the benefit of your IRA or qualified plan.

- Real Estate Valuation Form: You will need to locate an appraiser or real estate professional to complete and sign STRATA's Real Estate Valuation form in order to provide a current valuation for the property.

-

-

-

-

-

-

New Investment Document Submission:

You may submit pre-custody documentation through our Investment Hub. Gather your documents, select your asset type, then submit securely online.

In-Kind or Transfer of Directly Owned Real Estate Pre-Custody Process Overview

In-Kind or Transfer of Directly Owned Real Estate Pre-Custody Process Overview

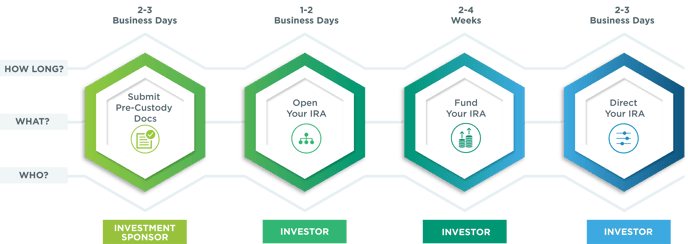

This timeline is approximate, based on if the required documents are received in good order. If transferring from another custodian or rolling over an IRA asset from another institution, STRATA is dependent on the existing service providers' transaction process times.

Once all the information has been completed and we have received all the necessary documentation, it will take up to 2-3 business days for us to determine whether STRATA is able to custody the asset. The documents listed above provide a guideline for in-kind transfers/rollovers of typical directly owned real estate. Please note that STRATA has the right to request additional documentation to complete the pre-custody process.

![]()

Directly Owned Real Estate Checklist

STRATA's Directly Owned Real Estate Checklist includes form links and a step-by-step guide. Download and save, email, or print!

Next Steps:

Next Steps:

Once your pre-custody paperwork is submitted and your asset is approved, then you are ready to open your STRATA IRA and direct your investment. After your investment funds, then you will need to provide STRATA with a newly recorded deed.

If your current custodian does not prepare a deed to convey the property to STRATA as custodian, you will need to contact an attorney or real estate professional to draft a new deed that is signature ready for your current custodian to sign. The deed must convey ownership to STRATA Trust Company Custodian FBO (Accountholder Name) IRA (Account #). You will then need to ensure the executed deed is recorded with the county and then send the original recorded deed to STRATA to be held in safekeeping.

![]() Additional Resources:

Additional Resources:

- Important Reminders for Real Estate Transactions

- What is the Pre-Custody Process for Directly Owned Real Estate Investments?

- STRATA IRA Fee Schedule - Overview account, processing, and service fees for your STRATA IRA.