What Is an Inherited or Beneficiary IRA?

An inherited IRA, also commonly referred to as a beneficiary IRA, is established when an individual inherits an IRA following the original IRA owner's death.

An IRA beneficiary can be any individual or entity named by the original account holder, as permitted by IRS guidelines. While beneficiaries cannot make annual contributions to an inherited IRA, the assets within the account retain their tax-deferred status and, in some cases, may even become tax-free or be eligible for rollover into another IRA, depending on the circumstances.

The options available to a beneficiary depend on their designation type, which impacts distribution requirements and timelines. To ensure the account is transferred according to your wishes—and to avoid potential delays or legal disputes—it’s important for IRA owners to keep beneficiary contact information up to date and clearly specify their designations. Accountholders may use STRATA's Beneficiary Designation/Change form to add, remove, or update designation status or contact information.

SECURE ACT 2.0 Updates to Beneficiary Titles

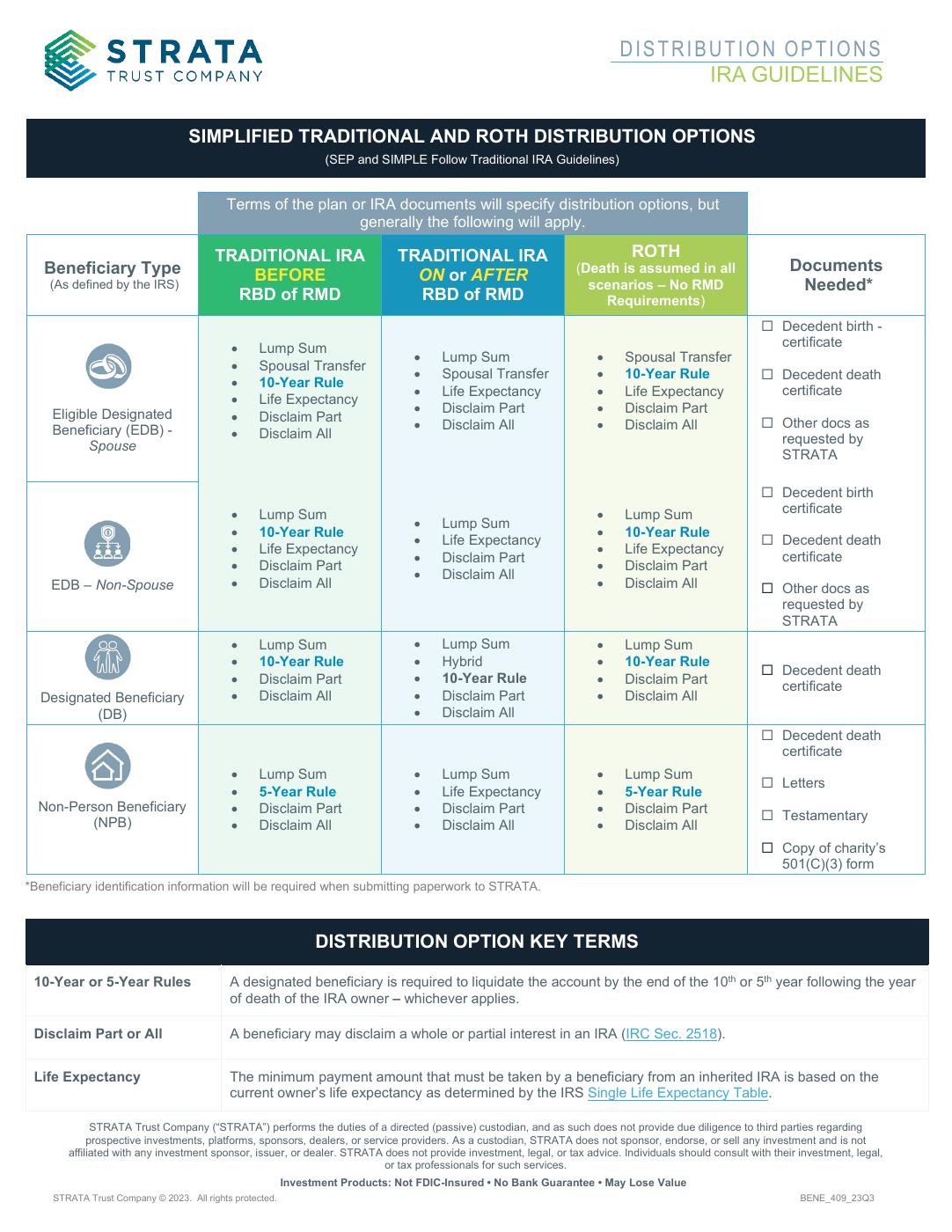

The SECURE ACT 2.0. became law on December 29, 2022, and impacted beneficiaries of IRAs among other things. The titles "Primary" and "Contingent" retained their respective titles and roles, while the title "Designated Beneficiary" no longer exists. Here is what you should know:

Beneficiaries were categorized into groups based on their need for the funds following the passing of the IRA owner:

- Eligible Designated Beneficiary (EDB) includes surviving spouses, disabled or chronically ill individuals, individuals not more than 10 years younger than the IRA owner, and children of the IRA owner who have not yet reached the age of majority.

- Designated Beneficiary (DB) encompasses adult children of the IRA owner, family members, friends, and other individuals.

- Non-Person Beneficiary (NPB) comprises estates, qualified trusts, and charities (must be a qualified 501(c)(3) entity).

Quick Reference Guide

For additional information, refer to IRS.gov and/or download STRATA's Distribution Options: IRA Guidelines to overview beneficiary distribution options and key terms.

Questions

For questions regarding tax implications or advice on what makes sense for your circumstances, connect with your tax, legal, or financial professional. For information regarding a STRATA IRA account or to make a beneficiary claim, reach out to STRATA's Beneficiary Concierge team at 866-891-8264.