What do beneficiaries need to know?

Beneficiary concierge support

If you need guidance on tax implications or determining what’s best for your specific situation, we recommend consulting with your tax, legal, or financial advisor.

For questions related to a STRATA account or to initiate a beneficiary claim, please contact STRATA’s Beneficiary Concierge Team at 866-891-8264. A dedicated representative will be assigned to assist you—from your initial inquiry through to the final settlement of the account.

Explore the FAQs below to find best practices, helpful insights, and additional resources—all designed to ensure the accountholder's wishes are carried out clearly and efficiently.

Quick Links: Claim process | Distribution | Reference guide

Claim process

1. Q: What documents are needed to submit a beneficiary claim?

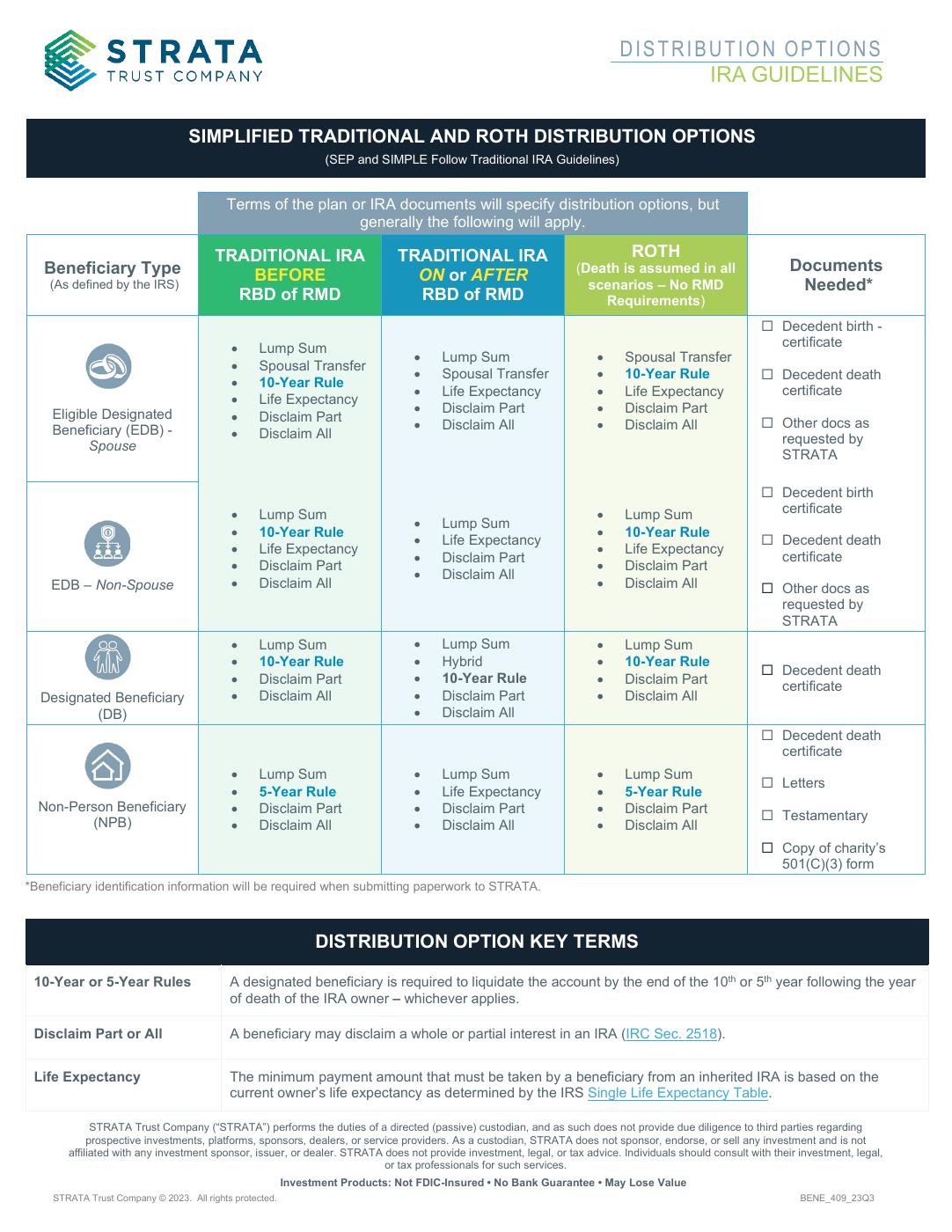

A: Depending on the beneficiary designation and account type, documents will vary. STRATA's Distribution Options: IRA Guidelines (linked below) provide an overview of what to expect, along with definitions of key terms.

An executor's last will and testament, or a divorce, cannot overturn a beneficiary designation unless ordered by a court. In such a case, the court order must be submitted for STRATA to review.

2. Q: What is needed if I am a beneficiary and I am a non-U.S. citizen?

A: In addition to the required documents listed on STRATA's Distribution Options: IRA Guidelines, a non-U.S. citizen must also provide IRS Form W-8BEN and a U.S. or foreign tax identification number.

3. Q: What are my options for receiving the inheritance of the IRA?

A: All beneficiaries have the option to either take a distribution or disclaim the inheritance of an IRA. The distribution options depend on the beneficiary designation (refer to STRATA's Distribution Options: IRA Guidelines).

If a beneficiary chooses to disclaim an IRA inheritance, it must be in writing, including the name of the disclaimed assets, and be initiated within 9 months of the date of death (additional state specific guidelines may apply). Once disclaimed, IRS rules require that the beneficiary cannot receive any benefits of inheritance either directly or indirectly.

4. Q: What if there are multiple beneficiaries and the IRA assets are illiquid or non-divisible?

A: Multiple beneficiaries can expect extended times to settle assets within an account if they are precious metals, real estate, or certain types of private and public investments. The distribution process becomes more complex when there is more than one beneficiary and the asset divisions are not clearly laid out, illiquid, non-divisible, and/or include multiple percentage amount assignments.

Beneficiaries will not have immediate access to funds—funds should not be counted on to manage immediate expenses. In order to settle the account per the IRA owner's wishes:

-

-

- Liquidation may be needed in order to make funds available. Assets may take time to sell, and the distribution can only be completed once funds are available.

- For multiple beneficiaries who want to claim non-divisible assets, such as a unique piece of property or specific precious metals, challenges may arise. The assets still must be divided according to the designation terms, and other adjustments may be needed in order to fulfill the terms of the beneficiary designation.

-

5. Q: Can a beneficiary access the decedent's online STRATA IRA account?

A: No, a beneficiary is not granted access to the decedent's online account. The assets are either distributed or transferred to a new inherited IRA account in the beneficiary's name. Once the inherited IRA account is opened, the beneficiary will be the new owner and will have their own online access.

Quick Links: Claim process | Distribution | Reference guide

Distribution

6. Q: Do beneficiaries pay taxes on inherited IRAs?

A: Tax treatment depends on the type of IRA inherited. For beneficiaries of a Roth IRA, contributions were made with after-tax dollars, so qualified distributions are generally tax-free. However, in certain circumstances, distributions to Roth beneficiaries may be partially taxable if the five-year holding period has not been met. Likewise, distributions to Traditional IRA beneficiaries may be partially nontaxable if the original IRA owner had a nondeductible basis in their account.

For beneficiaries of a Traditional IRA, contributions were made pre-tax, so distributions are typically taxable. Any taxable amount received must be included in the beneficiary’s gross income as required by the IRS.

7. Q: Is a beneficiary required to take an RMD?

A: Yes, a beneficiary who inherits an IRA account is subject to required minimum distribution (RMD) rules. Spousal beneficiaries who inherit an IRA have more flexibility than non-spouse beneficiaries and several factors determine if an RMD is applicable to the inherited IRA:

-

-

- Did the account owner pass after 2019?

- What is the beneficiary's relationship to the decedent?

- Did the decedent pass before or after their RMD date?

-

IRA custodians and trustees are not required to notify beneficiaries of RMD requirements. It is up to the beneficiary to calculate and complete RMD requirements. Consult a tax, legal, or other financial professional to better understand RMD requirements as they relate to your specific scenario.

8. Q: Are the fees that apply different for a beneficiary?

A: STRATA fees are the same for accountholders and beneficiaries. Refer to the STRATA's IRA Fee Schedule for a full list of account, processing, and transaction fees that may apply.

Quick Links: Claim process | Distribution | Reference guide

Reference guide

Several resources are available for beneficiaries including our Beneficiary Concierge team, IRS.gov, and STRATA's Distribution Options: IRA Guidelines.