What do accountholders need to know about beneficiary designations?

At STRATA, we understand the importance of a smooth and respectful transition during the beneficiary claim process. That’s why we have a dedicated Beneficiary Concierge Team to help ensure IRA accounts are handled with care and passed on according to your wishes.

Below, you’ll find answers to common questions about beneficiaries and your STRATA account—along with best practices and helpful resources to support a seamless transfer when the time comes.

Beneficiary designation

1. Q: How often should I update a beneficiary's contact information?

A: It’s important to keep your beneficiary’s contact information up to date. If STRATA is unable to reach a beneficiary due to outdated details—and contact cannot be made within a timeframe defined by state law—the assets may be escheated (transferred) to the state of the IRA owner's residence. To update or change beneficiary information, use STRATA’s Beneficiary Designation/Change form.

2. Q: What happens if the account owner gets a divorce?

A: A divorce does not automatically revoke a spousal beneficiary designation. If the account owner wishes to remove or change their beneficiary after a divorce, they must submit a new Beneficiary Designation/Change form.

3. Q: Can an executor or a will override a beneficiary designation?

A: No. A beneficiary designation on file with STRATA takes legal precedence over a will or the instructions of an executor—unless a court order states otherwise. In such cases, the official court order must be submitted for STRATA’s review.

4. Q: Can I have a minor as a beneficiary?

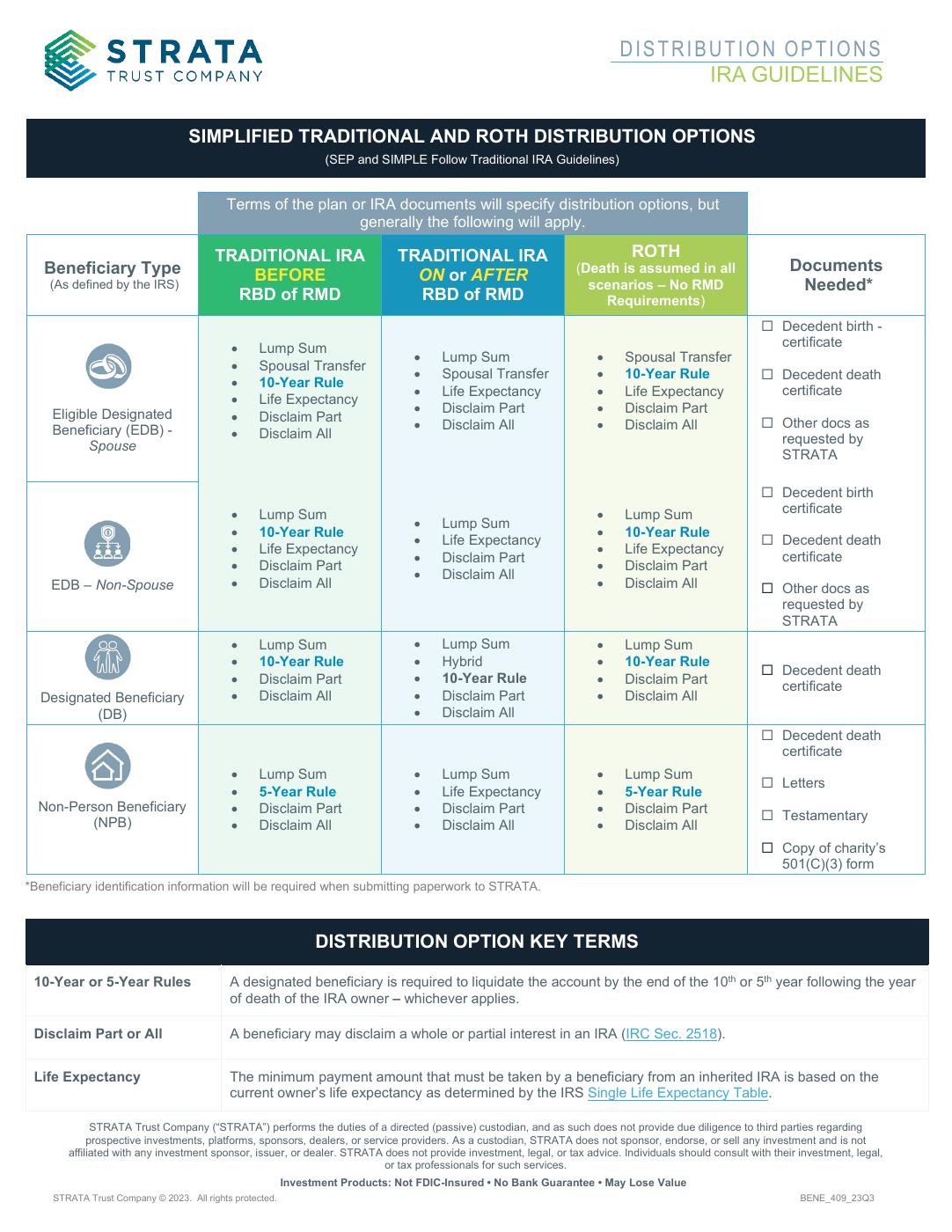

A: Yes, you can designate a minor as a beneficiary. If the account owner passes, an inherited IRA must be opened for the minor. Once the minor turns 21, they must open their own account and name new beneficiaries. At that point, required distributions must follow the 10-year rule. For more details, see STRATA’s Distribution Options: IRA Guidelines.

5. Q: What are the requirements for naming a qualified trust as a beneficiary?

A: To qualify as an IRA beneficiary, a trust must meet the following conditions:

-

-

-

Be valid under state law

-

Be irrevocable (or become irrevocable upon death)

-

Have clearly identifiable beneficiaries

-

Provide STRATA with a copy of the trust instrument or qualified trust documentation by October 31 of the year following the IRA owner’s death

-

-

6. Q: What happens if no beneficiary is designated on the account?

A: If no beneficiary is listed, IRA assets will pass to the account owner’s legal spouse. If there is no surviving spouse, the assets will be distributed to the estate of the deceased.

Asset distribution

7. Q: What if my assets are illiquid or non-divisible?

In these cases, beneficiaries should expect delays in accessing funds and should not rely on the account to cover immediate expenses. Settlement may take longer if:

-

-

Assets must be liquidated before funds can be distributed. Some assets may take time to sell, and distributions can’t be completed until the sale is finalized.

-

Non-divisible assets are involved, such as a unique property or specific metals. These can be difficult to split evenly, and adjustments (such as buyouts or alternative distributions) may be necessary to honor the terms of the beneficiary designation.

To avoid delays, consider discussing how complex assets should be handled with your financial and estate planning professionals.

-

Quick guide

Download STRATA's Distribution Options: IRA Guidelines to overview beneficiary distribution options, key terms, and more.

Questions

For questions regarding tax implications or advice on what makes sense for your circumstances, connect with your tax, legal, or financial professional. For information regarding a STRATA IRA account or to make a beneficiary claim, reach out to STRATA's Beneficiary Concierge Team at 866-891-8264.