What are the Annual Requirements for Directly Owned Real Estate FMVs?

The Internal Revenue Service (IRS) requires all custodians to obtain and report the fair market value (FMV)—or a good-faith estimate (GFE)—of each asset held in a retirement account annually and prior to certain taxable events, such as a distribution or Roth conversion. This information is reported to the IRS on Form 5498.

Because alternative assets, including directly owned real estate, are not traded on public exchanges, their values are not automatically available. As a result, self-directed account owners are responsible for providing an annual valuation updates using information obtained from their investment provider or a qualified, independent third-party valuation source.

The IRS uses FMV information to:

-

Confirm compliance with annual contribution limits

-

Determine whether required minimum distributions (RMDs) apply and are calculated correctly

-

Maintain the tax-advantaged status of your retirement account

Without accurate and timely valuation reporting, the IRS cannot properly administer retirement account rules, which can result in corrections, fees, or taxable events.

Article quick links: Acceptable methods | Valuation agent requirements | Additional submission requirements | Get started | Timeline details

Acceptable methods for determining FMV

For most annual updates, you can submit a current estimate of your property’s value using a trusted real estate website such as Zillow, Realtor.com, or Redfin—no appraiser or agent is required for this option. Third-party valuation sites do not include county tax assessments. Here’s how to submit a website valuation estimate:

-

Visit a real estate website and search for your property address.

-

Once the property page loads, confirm the address and estimated value shown on the screen.

-

Capture a screenshot that includes all required details:

-

Property address

-

Estimated value

-

Valuation website name

-

Screenshot date and time

-

-

Save the screenshot—you’ll upload it with your valuation form.

Article quick links: Acceptable methods | Valuation agent requirements | Additional submission requirements | Get started | Timeline details

When a valuation agent is required

In certain situations, a third-party website estimate is not sufficient, and supporting documentation from a qualified valuation professional is required.

⚠️ FMV Changes of 50% or More

If an updated FMV reflects a change of 50% or greater from the last value reported to STRATA:

-

Third-party website estimates cannot be used

-

You must submit a signed appraisal, BPO, or CMA from a qualified valuation agent.

A valuation agent must be:

-

Independent third-party

-

Certified or licensed

-

Not a disqualified person under Internal Revenue Code §4975

Acceptable valuation agent supporting documentation:

-

Certified real estate appraisal

-

Broker Price Opinion (BPO)

-

Comparative Market Analysis (CMA)

All documents must be signed by the valuation agent and clearly support the stated FMV.

Article quick links: Acceptable methods | Valuation agent requirements | Additional submission requirements | Get started | Timeline details

Additional submission requirements

-

Each asset requires a separate Fair Market Valuation – Real Estate form

-

Supporting documentation must be uploaded with the form when required

- If the valuation is received after the deadline, the updated value will reflect the form submission date, and any corrected tax forms may incur a correction fee. Please refer to STRATA’s IRA Fee Schedule.

- If you incur any fees from obtaining a valuation, they must be paid from your STRATA IRA. Submit STRATA's Expense Payment Authorization form.

Article quick links: Acceptable methods | Valuation agent requirements | Additional submission requirements | Get started | Timeline details

Ready to Get Started?

STRATA's Fair Market Valuation - Real Estate form includes fast, electronic submission through ServiceNOW. Accountholders can easily complete and sign the form, upload supporting documentation, and securely transmit their FMV update directly to STRATA. Click the form link above to get started. Select "Complete Online", then enter your email when prompted and follow the on-screen instructions.

Article quick links: Acceptable methods | Valuation agent requirements | Additional submission requirements | Get started | Timeline details

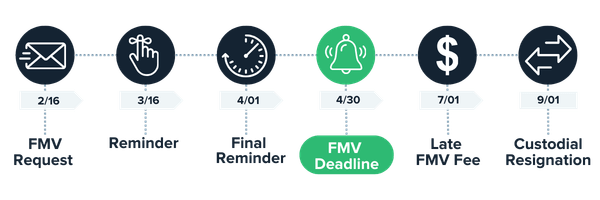

Directly Owned Real Estate FMV Annual Request Timeline

Directly Owned Real Estate FMV Annual Request Timeline

Annual updates are due to STRATA by April 30, in order to meet the IRS Form 5498 deadline of May 31.

If there is an exception or special circumstance that prevents you from meeting the April 30th deadline, the accountholder must notify STRATA at their earliest convenience at InvestmentUpdates@StrataTrust.com and include the expected date for your FMV. Service fees may apply.

Timeline details:

2/16 — First Request: STRATA will notify accountholders to provide us with an updated valuation as of December 31 (or within 12 months of the last FMV submitted).

3/16 — Reminder: STRATA will mail a reminder to accountholders if the valuation has not already been provided (and we have not received prior notice that the valuation will not be available until after April 30th).

4/1 — Final Reminder: If the valuation has not yet been provided, STRATA will mail a final reminder to accountholders that annual valuation update is due by April 30. This letter will also include potential actions/fees that may occur if the valuation is not provided to STRATA.

4/30 — FMV Deadline: All valuations must be reported to STRATA in order to meet the IRS deadline for filing Form 5498. FMVs reported after this date may require a corrected Form 5498 to be filed; if so, the $100 Corrected 5498 Fee will apply.

7/1 — Late Fee: A Late FMV Fee of $50 will be assessed if the valuation is not received prior to June 30. STRATA will also attempt to contact accountholders by email or phone to follow up on the late annual valuation. The Corrected 5498 Fee may apply.

9/1 — Custodial Resignation: If an annual valuation has not been provided by this date, STRATA must resign as custodian for the account and distribute the asset in-kind to you. The Late FMV fee and Account Closure Fee will apply. If a corrected 5498 is filed, the fee will apply as well. The distribution of the asset will be considered a taxable event, and penalties and additional taxes may be incurred.

Refer to STRATA's Fee Schedule for a full list of Service Fees.