IRS Form 1099-R

Why Would You Receive IRS Form 1099-R?

IRS Form 1099-R is issued when a reportable event occurs within your STRATA IRA. Taking a distribution of cash or an in-kind distribution of an investment from your IRA at any time is considered a reportable event, which will generate a 1099-R for the account.

STRATA will provide you with IRS Form 1099-R on or before January 31 of any year in which a reportable event occurs.

- If you have more than one retirement account with a distribution, you will receive a Tax Form 1099-R for each account.

- You will want to provide a copy of the tax form to your tax preparer when filing your taxes.

- You should include the value of your distribution in your taxable income for the tax year stated, although there are certain exceptions.

The IRS will receive a copy of your Tax Form 1099-R and will use it to match the taxable income and tax liability you report on your tax return, so it’s important to review your Form 1099-R and understand the information it is conveying to the IRS.

If you receive an IRS Form 1099-R, you will need to include certain information from that form on your income tax return:

If you receive an IRS Form 1099-R, you will need to include certain information from that form on your income tax return:

Box 1 – Gross distribution amount – This box reports the total amount withdrawn from the IRA before any federal or state income taxes were withheld. For a Traditional IRA distribution, this amount is typically taxable.

Box 2a – Taxable portion – This box reports the amount of the distribution that is taxable to the recipient. However, because IRA custodians cannot track basis in an IRA, custodians cannot report the taxable portion of IRA distributions. This box may either show the same amount as Box 1 or it may be blank. If Box 2a shows a dollar amount different from Box 1 and you timely removed an IRA excess contribution, the amount in Box 2a reports the taxable earnings removed with the excess.

Box 4 – Federal income tax withheld – Reports the amount withheld and sent to the IRS, if any, as a prepayment of tax. Include this amount on your income tax return as tax withheld, and if box 4 shows a dollar amount, attach Copy B to your return.

Box 7 – Distribution code – Alerts the IRS as to whether a distribution may be taxable or subject to the 10% early distribution tax. For some types of distributions, more than one code may apply. For example, codes 1 and 8 report the removal of an excess contribution from a Traditional IRA by an IRA owner younger than age 59½. Because the codes used on Form 1099-R alert the IRS to potential tax liability, it’s important that the correct codes are shown on Form 1099-R, or that you can explain the correct taxation on your tax return.

You can find a list of the most common distribution codes for Self-Directed IRAs and what they tell the IRS here: IRS Form 1099-R: Reporting 2024 IRA Distributions

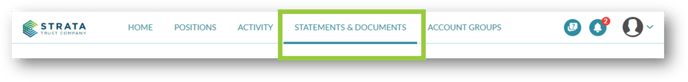

You can find a copy of your Tax Form 1099-R, on our online portal, under Statements & Documents.

Learn More:

Learn More:

- Visit the IRS to learn more about IRS Form 1099-R

For Additional Questions:

Contact our Client Service team at Services@StrataTrust.com or call 866-985-7156 during business hours (Monday – Friday, 8:00 am - 5:00 pm Central Time)