How Do I Send Investment Distributions to Investors?

Any investment distributions for IRA-owned assets must be sent directly to STRATA for the accountholder to preserve the tax advantages of the IRA.

To maintain the tax advantages of an IRA, all investment distributions should flow directly into the self-directed IRA. If funds are deposited into a personal account instead of your IRA, the amount is considered taxable income immediately. This means the accountholder would owe taxes on the full amount received and lose the tax benefits of the IRA, such as tax-deferred or tax-free growth, depending on the type of IRA.

Documentation:

- For any documentation submitted, STRATA’s Tax ID: 26-2637994 should be used in place of the investor’s SSN to avoid possible IRS confusion and retain the tax-exempt status for the IRA investment.

Payment Submission:

To ensure timely processing, please provide remittance instructions for all payments.

- One-Time Payments: Submit STRATA's Deposit Certification form for single payments.

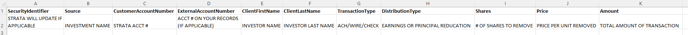

- Bulk Payments: To provide reconciliation instructions in bulk, use STRATA’s File Format for Bulk Payment template and securely email it to DepositInfo@StrataTrust.com.

Template example:

⚠️ Important: DO NOT submit personal information via regular email to ensure data security.