What Should the TIN on Schedule K-1 List?

Typically, investors that have investments generating unrelated business taxable income (UBTI) will receive a Schedule K-1 which is prepared by the investment issuer/sponsor ("Sponsor") and sent directly to the investor and the IRS. A copy of the K-1 is generally not sent to your IRA custodian.

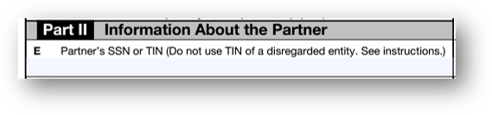

To avoid IRS confusion between your IRA income and personal income, it is important to verify the K-1 document reflects the correct tax identification number. Part II, box E of the K-1 requires a tax identification number (TIN) of the partner, and for IRA owners the document should reflect STRATA’s TIN of 26-2637994 or the standalone IRA EIN rather than an investor's social security number.

Investors that owe UBTI will work with their tax professional to determine if IRS Form 990-T will need to be filed. As a custodian for self-directed IRAs, STRATA does not review K-1, file IRS Form 990-T, nor do we advise on or calculate UBTI.